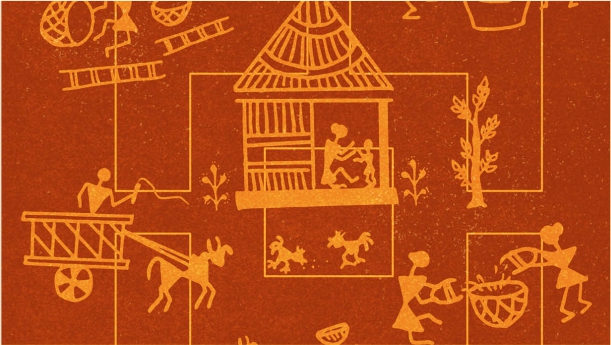

A look at HDFC Bank’s foray into rural India and how it navigated with relative ease by clearly

When HDFC Bank made its foray into the hinterland, there was a compelling vision that powered its goals—one that embraced a holistic, customer-focussed approach as opposed to a product-oriented one. The rural populace had for long been an underserved lot with respect to financial services, and the environment was strewn with challenges. However, the Bank navigated with relative ease by clearly distinguishing between financial access and financial inclusion, and optimally leveraging its technological expertise. Its sustainable livelihood initiatives have now reached over 28,000 villages across 27 states and its flagship Parivartan programme has impacted 7.8 crore people—a clear pointer to the Bank’s seminal role in redrawing India’s financial landscape.

On October 26, 2020, Aditya Puri, Founding Managing Director of HDFC Bank, stepped down from executive responsibilities at India’s largest private sector bank (by assets). His exit marked the end of the longest tenure of anyone at the helm of a bank in India. Under his leadership, in the 26 years since its inception, HDFC Bank’s market capitalisation increased to over R6 lakh crore, making it the largest bank in India by market cap. Interestingly, HDFC Bank’s market cap is larger than the combined market value of 22 listed public sector banks put together1 . In contrast, the State Bank of India, India’s largest bank, whose total assets are two-and-a-half times that of HDFC Bank, had a market cap of R1,90,000 crore in September 2020.

During this quarter century, the Bank handsomely rewarded its investors—over 23

Log In or become an AIMA member to read more articles